unlevered free cash flow calculator

Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. The formula to calculate unlevered free cash flow UFCF is as follows.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow aka Free Cash Flow to the Firm UFCF and FCFC for short refers to a Free Cash Flow available to all investors of a firm including Equity and Debt holders.

. To make sure you have a thorough understanding of each type please read CFIs Cash Flow Comparision Guide The Ultimate Cash Flow Guide EBITDA CF FCF FCFE FCFF This is the ultimate Cash Flow Guide to understand the. Heres a formula for UFCF. 21 Definition of Unlevered Free Cash Flow.

In the given example we have already put historical values from financial statements into the model. Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115.

It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. Unlevered FCF growth should slow down over time and by the end of 10 years it should be around the GDP growth rate or inflation rate 1-3 which it is here. Levered free cash flow LFCF measures the amount of money a company has left in its accounts after.

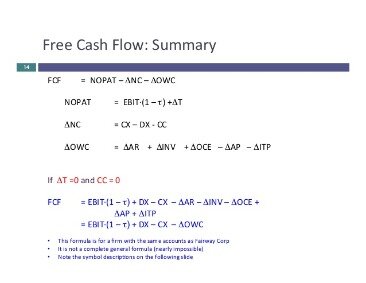

Unlevered Free Cash Flow - UFCF. Free Cash Flow to Firm FCFF Formula EBIT FCFF To calculate FCFF starting from earnings before interest and taxes we begin by adjusting EBIT for taxesEBIT is an unlevered profit measure since it is above the interest expense line and does not include outflows specific to one capital provider group eg lenders. You can see the entire formula in Excel below.

A business or asset that generates more cash than it invests provides a positive FCF that may be used to pay interest or retire debt service debt holders or to pay dividends or buy. A company can expand develop new products pay dividends reduce its debts or seek any possible business opportunities for the time being necessary for its expansion only if it comprises adequate FCF. To calculate Unlevered Free Cash Flow we start.

Unlevered free cash flow is also referred to as UFCF free cash flow to the firm and FFCF. Unlevered free cash flow UFCF is an anticipated or theoretical figure for a business that represents the cash flow remaining before all expenses interest payments and capital expenditures are made. The prefix un meaning not.

Essentially this number represents a companys financial status if they were to have no debts. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

Add back the companys Depreciation Amortization which is a non-cash expense. So it is often desirable for businesses to hold more. Purpose Of Calculating Levered Cash Flow.

EBIT Operating income income statement t tax rate computed by dividing income taxes by EBIT. Fcf Yield Unlevered Vs Levered Formula And Calculator Free cash flow yield is widely quoted by analysts and gives investors a useful insight into whether a share is cheap or expensive. The short answer is no unlevered cash flow does not include interest.

Unlevered Free Cash Flow Formula. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. The name itself is a give-away.

The formula to calculate the unlevered free cash flow for a company is the following. Unlevered free cash flow is the cash flow a business has excluding interest payments. How Do You Calculate Unlevered Free Cash Flow.

The completed model output is shown below. UFCF is a measure of a firms cash flow deprived from the firms core-business operation. Next we have to calculate the Discount Rate and use it.

Free cash flow to the firm Also called unlevered FCF. Its the amount of cash a business has after it has met its financial obligations. Lets see the use of the formula in the DCF model in the example below.

In other words its a measure of how much cash is generated by a companys core operations ie. Multiply by 1 Tax Rate to get the companys Net Operating Profit After Taxes or NOPAT. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this.

The difference between UFCF and LFCF is the financial obligations. Its business activities that do not include investments in other companies debt repayments and so on. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF.

So these are the cash flow the company is free to use however it likes because it has already paid its bills and reinvested into future growth. What is Financial Modeling Financial. Unlevered free cash flow is the money the business has before paying its financial.

Hopefully this free YouTube video has helped shed some light on the various types of cash flow how to calculate them and what they mean. What is levered free cash flow. Unlevered FCF Net Income DA Capex Working Capital.

Its the money the business has before paying its financial obligations. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. Unlevered free cash flow can be reported in a companys.

Formula and Calculation of Levered Free Cash Flow LFCF There is more than one way of calculating LFCF. Unlevered free cash flow is a financial metric used to calculate the cash generated by a business before taking interest and taxes into account. Free cash flow yield or FCF yield is a valuation metric to measure the yield of a firms free cash compared to its size.

Because it doesnt account for all money owed UFCF is an. Looking at cash flow is a great way for investors to check the financial health of a business while calculating levered free cash flow is one of the most effective ways to determine profitabilityFind out how to calculate levered free cash flow and more. Unlevered Free Cash Flow.

Users can arrive at LFCF from EBITDA net income or UFCF. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash Working Capital. Leverage is a term that financiers use to indicate the use of debt.

Start with Operating Income EBIT on the companys Income Statement. Unlevered Free Cash Flow Definition. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another.

Levered cash flow is the amount of cash a business has after it has met its financial obligations. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company. Examples of financial obligations covered by levered cash flow are.

Unlevered FCF simply means looking at a companys cash flow before the effects of debt are taken into account ie CF to all the capital providers. Free cash flow to equity Also referred to as levered FCF. UFCF EBITDA - CAPEX - Working Capital - Taxes.

Unlevered FCF EBITDA CapEx Working Capital Tax Expense.

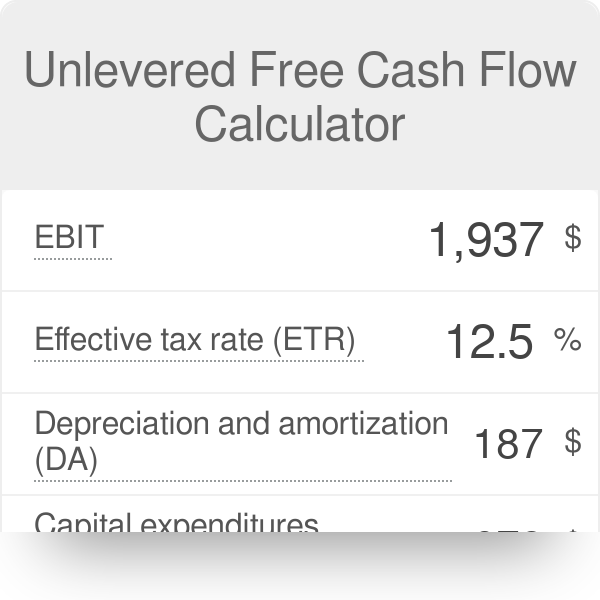

Unlevered Free Cash Flow Calculator Ufcf

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Formula Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Wave Accounting

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)