operating cash flow ratio importance

Because this value is greater than one it indicates that the company has enough cash. The Operating Cash Flow Margin also called the Cash Flow Margin or simply the Margin Ratio is one of the most commonly used profitability ratios.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

The key here is to focus on your companys regular business operations.

. How to calculate the operating cash flow ratio. Operating Cash Flow Ratio. Divide Targets annual revenue of 176 billion by the companys operating cash flow ratio of 034 and you obtain a total of 6 billion.

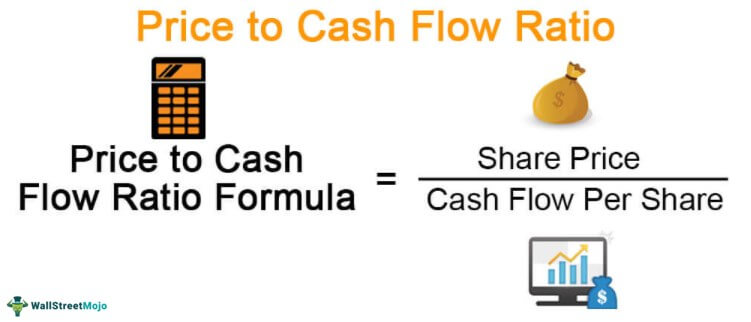

The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. CFO CL OCF Ratio. Cash flow to revenue.

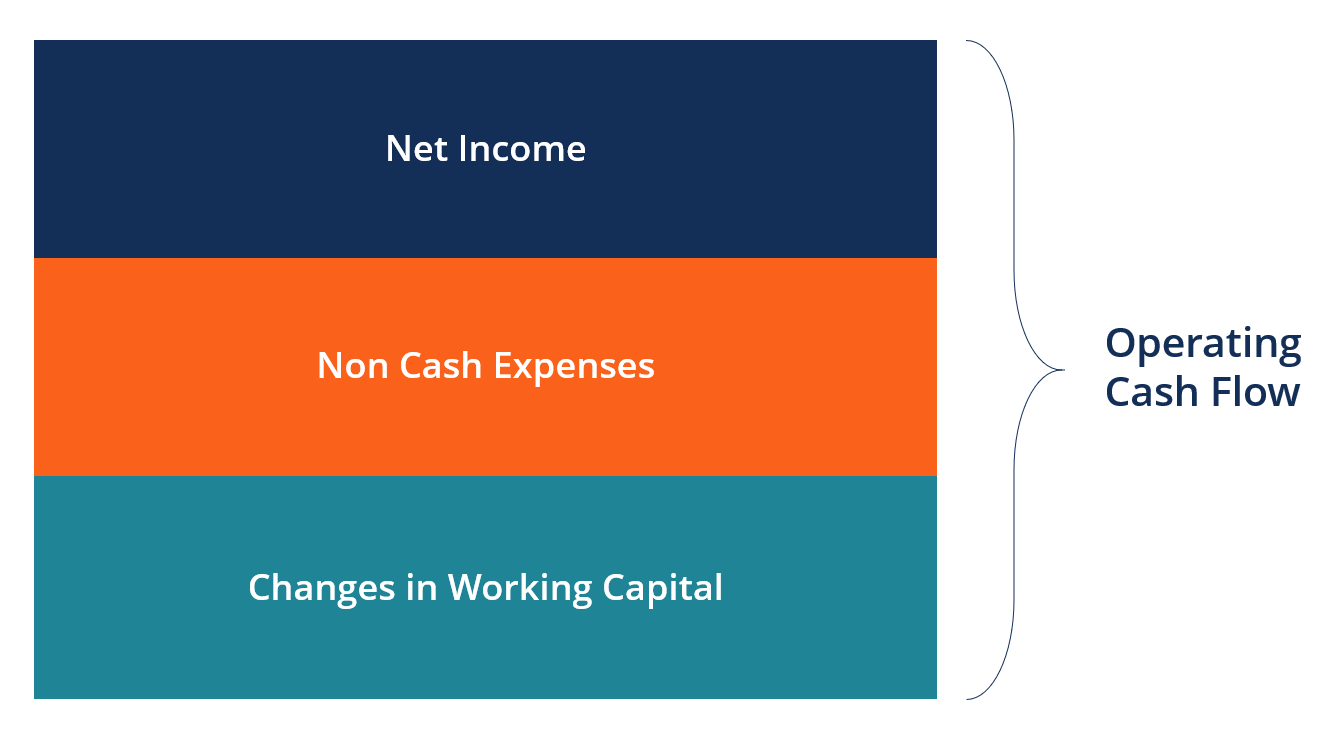

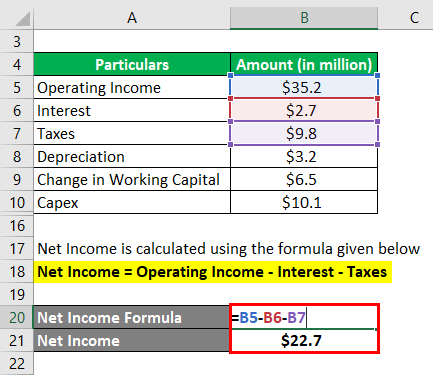

Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses. HSBC Can Help You With That. Walmarts operating cash flow ratio is 036 or 278 billion divided by 775 billion which is equal to 278 billion divided by 775 billion.

By using the formula the financial analyst finds that the company has an operating cash flow ratio of 14. Operating cash flow is the cash generated through a. Conceptually this ratio is similar to the.

The operating cash flow ratio can be used to assess a companys short-term financial health and is an important consideration for investors who are evaluating a potential investment. 100000 50000 20000 25000 10000. The formula for your operating cash flow ratio is a simple one.

A commonly used cash flow metric is cash flow from operations CFO. A ratio smaller than 10 means that your business spends more than it makes from operations. Here is the formula for calculating the operating cash flow ratio.

A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. Speak To An HSBC Representative To Learn More About Our Commercial Banking Services. Lets take each component individually to understand what number needs to be plugged in.

Start by calculating your incoming cashyour CFO. Operating cash flow ratio 140000 100000. To calculate the ratio simply divide the operating cash flow by the total revenue.

The Formula to Calculate the Operating Cash Flow Ratio. Now that a definition has been established its time to look at how to calculate operating cash flow ratio. Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth.

As evidenced by their identical liquidity ratios both. Put another way it shows how efficient or inefficient your company is at. Operating Cash Flow 55000.

The higher the number is the more your business is making. Get 3 cash flow strategies to stop leaking overpaying and wasting your money. Its a measure of how much money you are generating from your operations per every dollar in sales you bring in.

Operating cash flow ratio operating cash flow current liabilities. It measures the amount of operating cash flow generated per share of stock. Important cash flow ratios include cash flow per share cash to income debt coverage interest coverage cash return on equity and cash return on assets.

The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. Operating cash flow ratio 14. Lets calculate Radhas store by using the indirect method.

Cash flow ratios are financial ratios in which either the numerator or the denominator or both is a cash flow figure. Then we compare them with other financial indicators including the companys stock price. Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you make.

Cash Flow from Operations CFO divided by Current Liabilities CL or. The operating cash flow. Ad The Key To Success Is Gaining More Control Over Cash Flows.

Operating Cash Flow Ratio Operating cash flow Current Liabilities¹ ². Operating cash flow Net cash from operations Current liabilities. However some analysts may use other metrics such as Funds from operations FFO and free operating cash flow FOCF.

This ratio is generally accepted as being more reliable than the priceearnings ratio as it is harder for false internal adjustments to be made. Ad 93 of small business owners are constantly leaking money on useless and unnoticed things. So we can see that Radha succeeded in generating 55000 of cash flows from her operations.

Financial accounting ratios which are based on income statement andor.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Free Cash Flow Formula Calculator Excel Template

Operating Cash Flow Formula Overview Examples How To Calculate

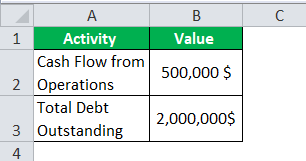

Cash Flow To Debt Ratio Meaning Importance Calculation

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Cash Flow From Operations Ratio Formula Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Operating Activities Direct And Indirect Method Efm

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Conversion Ratio Financial Edge

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Definition Formula Example

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Ratio Calculator

Operating Cash Flow Efinancemanagement Com

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template